When someone might not be an expert in any one field, they can be the best resource for finding the right expert.

I can find you the right person to help you sleep better at night.

As a Polymath Consultant, I specialize in helping startups and SMEs grow by improving how they operate and build their team culture. I work with you to check how your business is doing, pinpoint areas to get better, and craft a growth and change strategy. Also, my coaching helps entrepreneurs strengthen their leadership and accomplish their personal and business aims. With my deep knowledge of the business world and a network of reliable experts, I ensure you get top-notch support exactly when you need it, leading to your business's success and expansion.

Professional And Dedicated

Unleash the Power of Connection: Your Business, Your People, Your Success.

Services that Fit Your Needs: No matter if you have one employee or a whole company, our services can be customized to meet your specific needs.

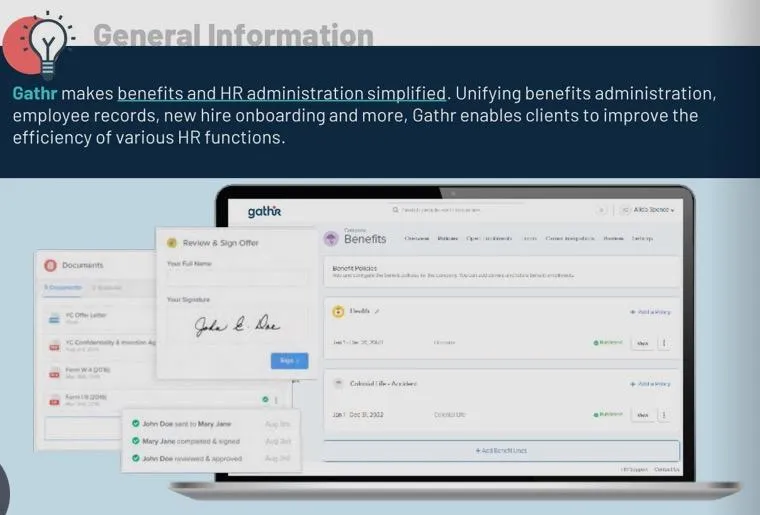

Unlock the Power of an Integrated Solution: Manage Like Never Before!

Our Business Foundation

At PDX Benefits, we pride ourselves on the qualities that set us apart and drive our success.

Our commitment to excellence is evident in every aspect of our operations, ensuring that we provide exceptional value and service to our clients.

Discover the core qualities that define our business:

Reliability and Trustworthiness

Ethical

Practices

Exceptional Customer

Service

Our solid track record speaks for itself. We are dedicated to providing consistent and reliable service, fostering trust and confidence among our clients. You can rely on us for stability and dependability.

We conduct our business with the utmost integrity, prioritizing ethical practices and fostering a culture of honesty and respect. Our commitment to ethical behavior ensures that we always act in the best interests of our clients.

Our clients are at the heart of everything we do. Our dedicated customer service team is always ready to assist you, addressing your concerns promptly and efficiently. We strive to provide a seamless and satisfying experience.

Expertise and Guidance

Cutting-Edge Technology

Transparency

Regulation and Licensing

Benefit from the insights and guidance of our experienced professionals. Our team offers expert advice and in-depth analysis to help you navigate the markets effectively and achieve your financial objectives.

Stay ahead of the curve with our advanced trading platforms and research tools. We provide the latest technology to help you make informed decisions, including educational resources to enhance your knowledge and skills.

We believe in maintaining complete transparency with our clients. From clear communication about fees and commissions to honest disclosure of potential conflicts of interest, we ensure that you are always fully informed.

We operate under the stringent regulations of recognized financial authorities, ensuring that our services meet the highest standards of integrity and security. Our licensing is a testament to our commitment to operating within legal and ethical frameworks.

Areas of Service

Click the Image for that Area to Learn More

How Can I Utilize The Community to Benefit You?

Reliable, Collaborative, Resourceful, with Integrity.

Leave Your Worries to Me

Employer paid supplemental insurance

Employer Paid Supplemental Insurance

In the world of employee benefits, supplemental insurance is gaining traction. It's a work perk that can provide added financial protection for employees.

Employer-paid supplemental insurance can fill the gaps left by traditional insurance plans. It can cover unexpected costs that primary health insurance may not fully cover.

This article will delve into the benefits and considerations of offering this type of insurance. Whether you're an employer or an employee, you'll gain valuable insights into this aspect of group benefits.

Understanding Supplemental Insurance

Supplemental insurance is a type of coverage that complements primary health insurance. It's designed to cover costs that your main insurance may not.

These costs can include deductibles, co-pays, and other out-of-pocket expenses. They can arise from accidents, critical illnesses, or disability.

By offering supplemental insurance, employers can provide a safety net for their employees. It's a way to enhance financial security and peace of mind in the face of unexpected medical expenses.

Types of Employer-Paid Supplemental Insurance

There are several types of supplemental insurance that employers can offer. Each type is designed to cover specific areas of health and wellness.

Accident insurance: This covers costs related to accidental injuries.

Critical illness insurance: This provides a lump sum payment if an employee is diagnosed with a covered critical illness.

Disability insurance: This replaces a portion of an employee's income if they become disabled and can't work.

Life insurance: This provides a death benefit to the employee's beneficiaries.

By offering a range of supplemental insurance options, employers can cater to the diverse needs of their workforce.

Benefits of Offering Supplemental Insurance as an Employer

Offering supplemental insurance can be a win-win for employers. It not only enhances the company's group benefits package but also shows employees that their well-being is a priority.

One key benefit is the potential for increased employee satisfaction and retention. When employees feel valued and cared for, they are more likely to stay with the company.

Supplemental insurance can also provide tax benefits. Employers may be able to deduct the cost of premiums as a business expense.

Finally, a comprehensive benefits package, including supplemental insurance, can give businesses a competitive edge in attracting top talent. It's a work perk that can set a company apart.

“We know premiums are what drive decision-making in terms of enrollment” - Liz Hagan, Director of policy solutions for United States of Care

How Supplemental Insurance Enhances Group Benefits

Supplemental insurance can significantly enhance a company's group benefits. It fills the gaps left by traditional insurance plans, covering out-of-pocket expenses like deductibles and co-pays.

This added layer of financial protection can be a game-changer for employees. It provides peace of mind in the face of unexpected medical expenses.

Moreover, supplemental insurance can complement wellness programs, contributing to a holistic employee benefits strategy.

The Impact on Employees: Financial Protection and Peace of Mind

Employer-paid supplemental insurance can have a profound impact on employees. It offers financial protection, covering costs not met by primary insurance.

This can lead to significant cost savings in the event of medical emergencies. It also provides peace of mind, knowing that unexpected expenses won't lead to financial hardship.

In essence, supplemental insurance can enhance financial security for employees and their families. It's a valuable work perk that can boost employee satisfaction and retention.

Implementing Employer-Paid Supplemental Insurance: Steps to Take

Implementing employer-paid supplemental insurance requires careful planning. First, employers need to understand the diverse needs of their employees. This can be achieved through surveys or direct feedback.

Next, it's crucial to work with reputable insurance providers. They can guide employers through the process, ensuring the chosen plan meets the needs of the workforce.

Lastly, employers must communicate the benefits of supplemental insurance to employees. This includes explaining the coverage and how to enroll. Clear communication can help employees appreciate this valuable work perk.

Conclusion: The Value of Employer-Paid Supplemental Insurance in Work Perks

Employer-paid supplemental insurance is more than just a work perk. It's a tool that can enhance employee satisfaction and retention. It provides financial protection and peace of mind to employees, making them feel valued.

Moreover, it complements traditional insurance plans, filling the gaps in coverage. This can lead to significant cost savings for employees during medical emergencies.

In conclusion, offering supplemental insurance as part of group benefits is a strategic move. It not only benefits employees but also gives businesses a competitive edge.

Good Business is

everyone's business.

Copyright 2024 . All rights reserved

Frequently Asked Question

Do I Have To Pay Any Fees To Ask Questions OR To Review My Business

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae.

If I have benefits in place do I have to switch to what you offer?

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae.

What Kind of Process would this be?

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae.

Testimonial

Don’t take our word for it, hear what our happy clients have to say

Amazing Service. They are very professional and sincere about helping people. I would definitely recommend their consultants to everybody.

John Doe

CEO, Unipie

Amazing Service. They are very professional and sincere about helping people. I would definitely recommend their consultants to everybody.

Jane Doe

CEO, Unipie

Facebook

Instagram

LinkedIn